Note: This post was originally published January 7, 2020. It has since been updated and republished.

When I promote a new listing on Facebook, I often receive comments from local users like…

- Housing prices in Fort Erie have gone crazy. I’ve lived and worked here all my life but I won’t be able to afford to retire here.

- How are young families ever supposed to be able to buy their first house?

- I’m barely getting by as it is. I’ll never be able to buy a home of my own.

You get the idea.

While concerns about affordable housing are perfectly valid — and I will touch on this later — I thought I’d take a moment to dive into what the average household (or family) can realistically afford in this area.

How much does the average Fort Erie household earn?

Let’s start with defining average.

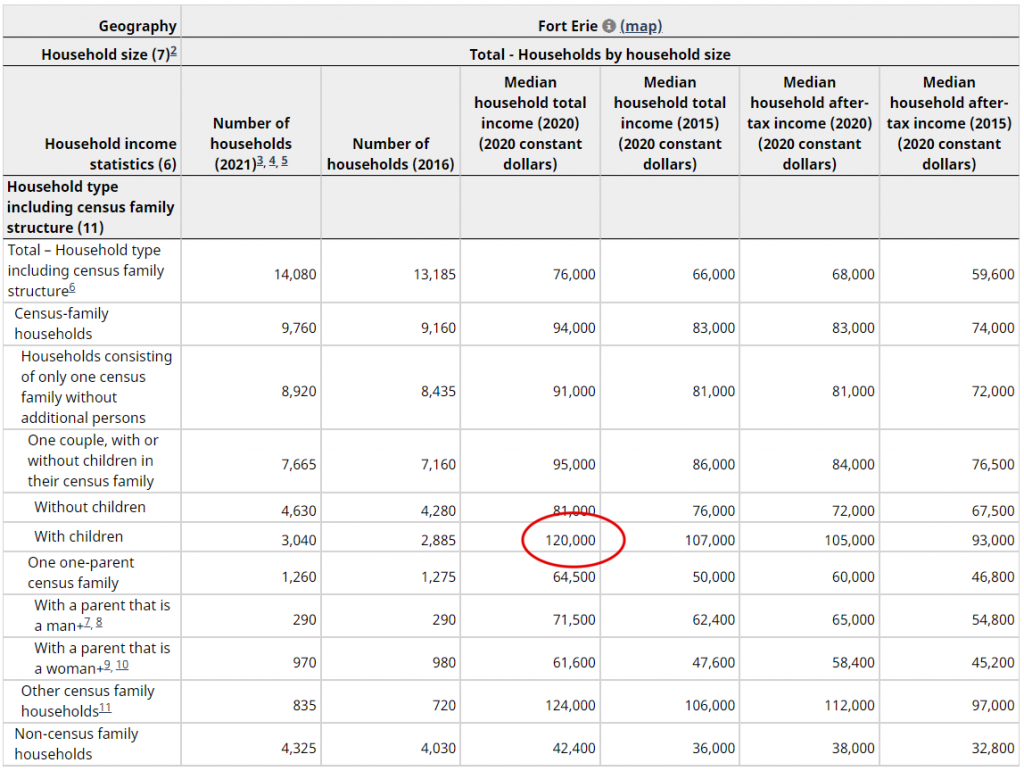

According to Statistics Canada, the median census-family household with children in Fort Erie had a total income of $120,000 for 2020. After taxes, this same median household was left with $105,000.

Of course, your household income in 2020 may have been above this median or it might have been below this median.

That’s what makes this number a median — exactly half of all households made more and half made less, which makes it a better indicator of household spending power in Fort Erie compared to an average alone.

That being said, these are the figures I will be using when referring to the average Fort Erie family for the balance of this article.

Can the average Fort Erie family qualify for a mortgage?

If the average Fort Erie family earns $120,000 annually, what is the most that family can qualify for?

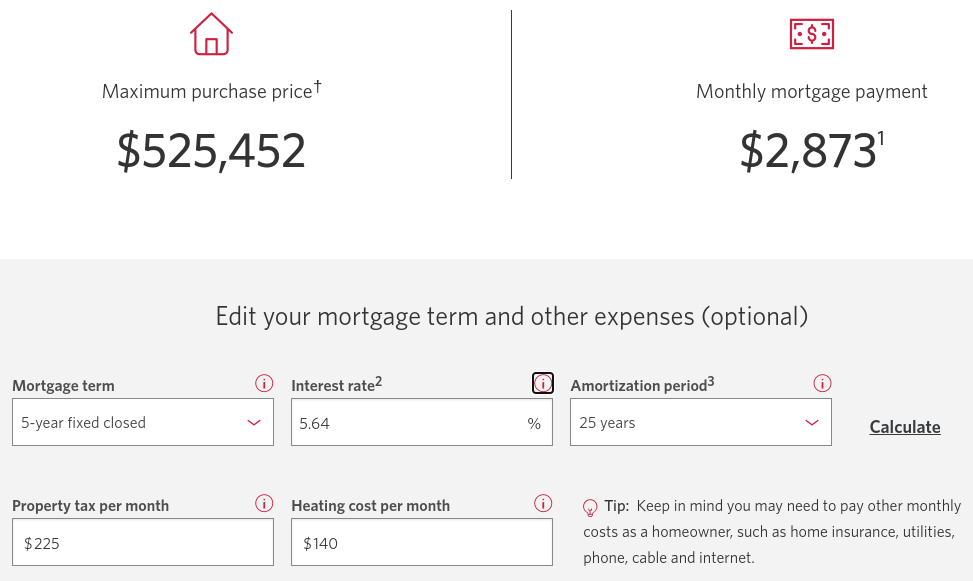

Well, according to CIBC, assuming that family…

- carries no debt,

- has relatively good credit,

- spends a maximum of $225 per month on property taxes,

- spends an estimated $140 per month on heating, and

- has managed to save a $75,000 down payment,

…they would qualify to purchase a Fort Erie home for up to $525,452.

The down payment is the trickiest part, of course.

If an inheritance, a family gift, or existing home equity are all out of the question, it can take several years of saving to accumulate such a significant amount of cash. This often is a real challenge for first-time buyers looking to enter the market, but there are programs available to help.

Note: In the example above, the federal “stress test” (first introduced in 2018) was applied when calculating the maximum purchase price.

What does the average home in Fort Erie cost?

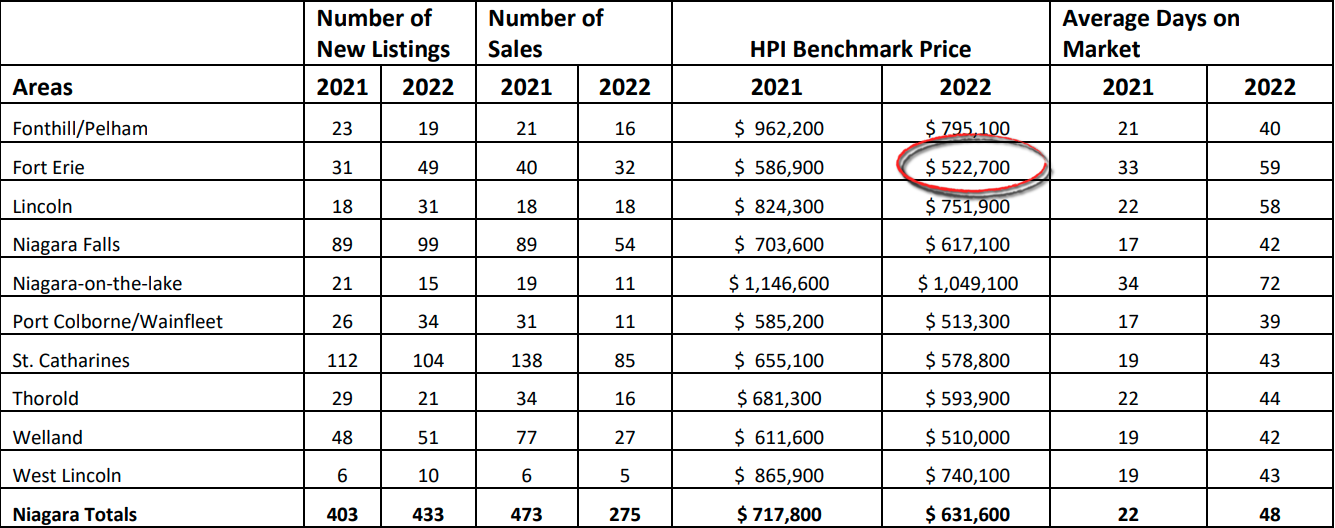

According to the Canadian Real Estate Association (CREA), house prices are most accurately compared using the Home Price Index (HPI). Here is a brief explanation:

Average or median prices can change a lot from one month to the next and paint an inaccurate or even unhelpful picture of price values and trends. The MLS® HPI is based on the value home buyers assign to various housing attributes, which tend to evolve gradually over time. It therefore provides an “apples to apples” comparison of home prices across the entire country.

In other words, the HPI serves as a more useful average. Rather than including three-season cottages, one-bedroom condos, vacant building lots, and fifty-acre farms in our average, we instead compare apples to apples (similar homes).

Here in Niagara, we sort those “apples” using the following benchmarks:

- Above Ground Bedrooms: 3

- Age Category: 51 to 99

- Bedrooms: 3

- Below Ground Bedrooms: 0

- Exterior Walls: Masonry & Siding

- Freshwater Supply: Municipal waterworks

- Full Bathrooms: 2

- Garage Description: Attached, Single width

- Gross Living Area (Above Ground; in sq. ft.): 1,276

- Half Bathrooms: 0

- Heating: Forced air

- Heating Fuel: Natural Gas

- Number of Fireplaces: 0

- Total Number Of Rooms: 7

- Type Of Foundation: Basement, Poured concrete

- Wastewater Disposal: Municipal sewers

Where am I going with all this?

Well, according to the Niagara Association of Realtors, the price of a Fort Erie home meeting the above benchmarks for December 2022 was $522,700, down roughly 10.9 percent since this time last year and approx. 17.2 percent less than the Niagara regional average.

Obviously, some homes in Fort Erie sell for more than $522,700 while others sell for less, but this is the dollar figure I will use to represent the average Fort Erie house price for the balance of this article.

What can the average Fort Erie family afford?

Let’s suppose that our average family noted above, who earns an annual income of $120,000, decides to buy a home in Fort Erie.

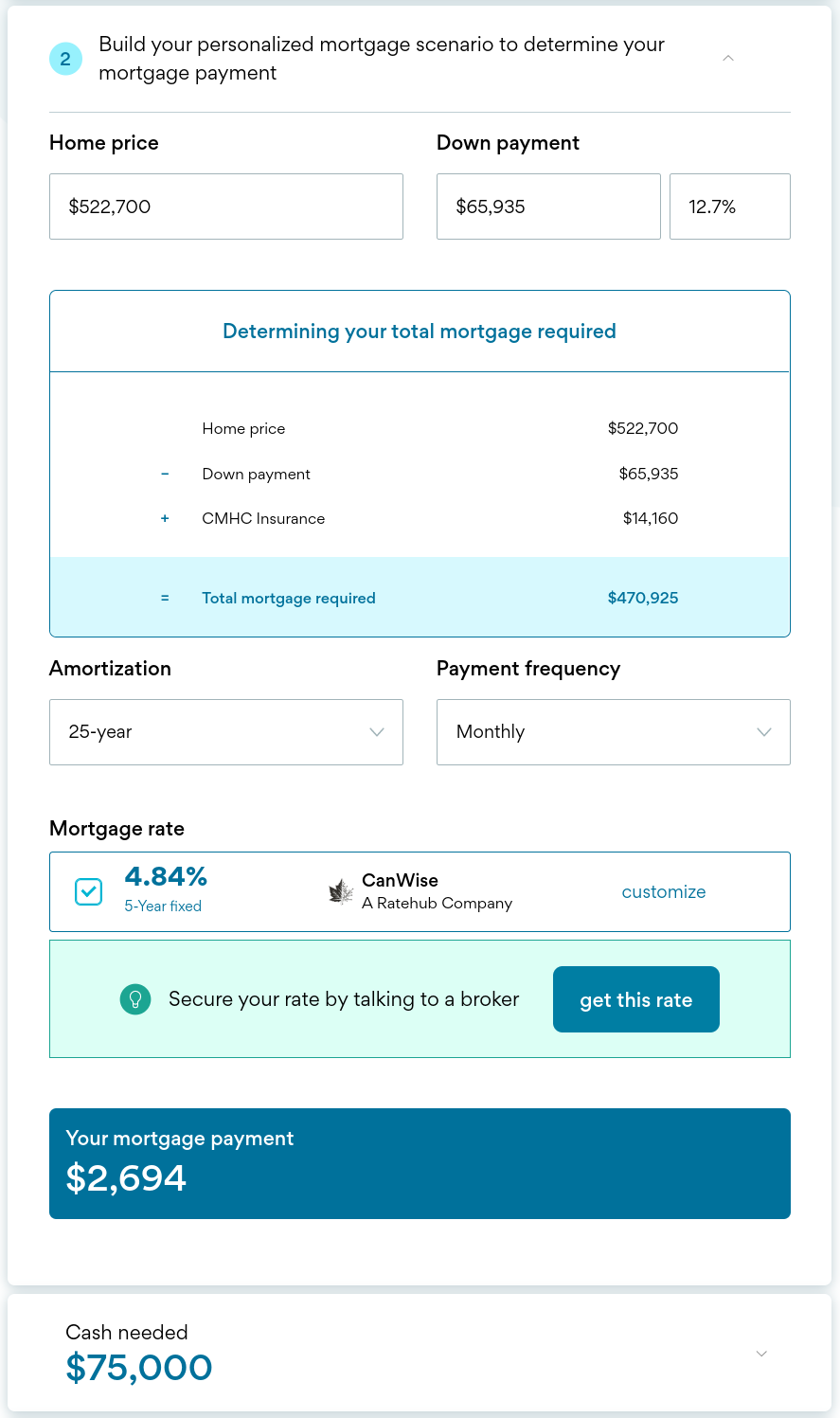

We know lenders will approve them for more, but let’s assume they wish to buy a Fort Erie home meeting the benchmarks noted above for $522,700. You know, the average Fort Erie home.

They put down $65,935 and set aside $9,065 for closing costs, a total of $75,000 cash.

They apply for a mortgage to cover the balance of the purchase price, which works out to $470,925 (factoring in CMHC Insurance).

The average Fort Erie family is approved and moves into the average Fort Erie home.

Their monthly mortgage payment, according to Ratehub.ca, will be $2,694 at 4.84 percent. Bear in mind, of course, that different lenders offer different rates at different times.

Isn’t money tight for our average family?

Remember how I noted earlier that the average Fort Erie family has an after-tax income of $105,000? I did this for a reason.

Divided evenly throughout the year, this average family has a monthly after-tax income of $8,750.

Taking away their monthly mortgage payment of $2,694, they are left with $6,056 which, in my estimation, would be enough to feed and clothe their family, cover utilities, property taxes, and insurance, fill the gas tank a few times, and have a little bit left over.

It is also worth noting that some families prefer to live below their means and purchase a home for less than the benchmark price.

How does this compare to renting a home in Fort Erie?

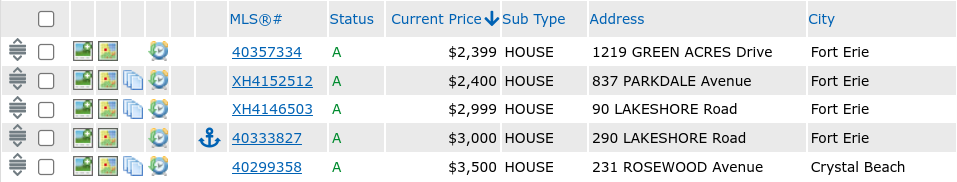

It’s no secret that long-term Fort Erie rentals are scarce. At the time I am writing this, there are five detached Fort Erie homes available that meet most or all of the benchmark criteria noted above:

Rent amounts range from $2,399 to $3,500 per month, which is not so different from our average family’s mortgage payment of $2,694. And don’t forget that, much like homeowners, tenants often have to pay their own utilities and insurance.

What does this mean?

Well, in a lot of cases, the cost to rent a home is even more expensive than the cost to purchase one. Not to mention that some rentals are only temporary and tenants gain zero equity in their homes.

But what about those who are not average?

You might be reading this thinking that, based on the examples I have provided, you can neither afford to purchase nor rent a Fort Erie home.

This is absolutely the case for a lot of people. Historically speaking, about 68 percent of Canadians will enjoy home ownership at some point in their lifetime. The other 32 percent will not. And, of course, this is the case for a variety of different reasons.

Please make no mistake: affordable housing remains a critical issue not just across Niagara Region, but all of Canada.Click To TweetPlease make no mistake after reading this article:

Affordable housing remains a critical issue not just across Niagara Region, but all of Canada, and I do not mean to make light of how serious an issue it is.

That said, the real estate market is governed by supply and demand. If the average family could not afford a home in Fort Erie, the average seller would have to reduce his or her asking price.

TL;DR

The average family in Fort Erie can afford to purchase the average Fort Erie home, and the term “affordable” varies wildly based upon individual circumstances.

What is affordable to one person (or family) may or may not be affordable to the next.

Brent is a sales representative with RE/MAX Niagara Realty Ltd., Brokerage. He’s the founder of Fort Erie Radio and proud to call Fort Erie his home.